According to the Wall Street Journal, 'tech conglomerate' International Business Machines Corp. (IBM) is in talks to purchase storage systems industry peer Sun Microsystems (JAVA). While terms are still being negotiated, rumors suggest IBM is willing to pay up to $8 Billion in cash to acquire its one-time rival. If true, the acquisition would easily surpass the company's $5 Billion purchase of Cognos in January 2008 to become the most expensive deal in IBM's near 100 year corporate history (FYI, Sun currently has about $2.5 Billion in cash sitting on its balance sheet so the real/net cost of the deal to IBM would probably be somewhere around $5.5 Billion).

According to the Wall Street Journal, 'tech conglomerate' International Business Machines Corp. (IBM) is in talks to purchase storage systems industry peer Sun Microsystems (JAVA). While terms are still being negotiated, rumors suggest IBM is willing to pay up to $8 Billion in cash to acquire its one-time rival. If true, the acquisition would easily surpass the company's $5 Billion purchase of Cognos in January 2008 to become the most expensive deal in IBM's near 100 year corporate history (FYI, Sun currently has about $2.5 Billion in cash sitting on its balance sheet so the real/net cost of the deal to IBM would probably be somewhere around $5.5 Billion).

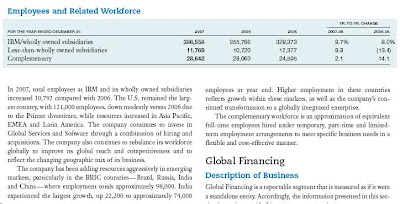

With the acquisition of Santa Clara, California-based Sun Micro, IBM would immediately be adding some 35,000 new employees and about $13 Billion to annual company sales. More importantly though, the purchase of Sun would allow #1 IBM to significantly increase its lead in worldwide server marketshare over #2 Hewlett Packard (HPQ). Per the below pie chart, IBM's server marketshare would increase by 10.1% and total 42% as a result of the acquisition...meanwhile, HP's share number holds steady at 29.5%. Scary as that might be, perhaps an even more daunting prospect for the rest of the server industry would be the potential $8 Billion deal's impact on IBM's worldwide UNIX server marketshare. If the deal were to go through and of course pass regulatory approval then IBM's UNIX share would instantly soar an enormous 28 points to a MONOPOLISTIC 65.3% !

Per the below link, IBM appears interested in doing the deal for several reasons, including:1.) INSTANT MARKETSHARE - IBM will immediately gain 10 points of marketshare in overall worldwide server sales2.) 'HOT' END USERS - Many of Sun's customers operate in the telecommunication and government sectors of the economy...two end user industries IBM is explicitly targeting and focused on growing during today's relatively tepid macroeconomic backdrop

3.) LEVERAGE IBM's CORE S + S - IBM will attempt to sell its carefully-crafted, higher margin bundles of server-oriented Software + Services to its newly acquired storage system customers4.) LEVERAGE SUN's CORE R + D - IBM will seek to leverage the fruits of SUN's widely regarded Research + Development efforts (JAVA, Solaris, SQL, solid state storage drives, advancements in cloud computing, etc.) into its own existing and future products/solutionsonline.wsj.com/article/SB123742081606578475.htmlData Courtesy: The Wall Street JournalFull Disclosure: I own shares of IBM.

Jim Cramer, arguably CNBC's loudest and most famous stock market commentator, was interviewed on Thursday, March 12th by savvy late night comedy news show host Jon Stewart. In the surprisingly edgy and riveting fifteen minute Daily Show segment, Stewart takes a somewhat uncharacteristically somber approach and demands accountability from the Wall Street media and more specifically, CNBC, the #1 U.S. financial news television network. Mr. Stewart seems especially focused on discussing what he (and perhaps many others) perceived as the TV station's collective 'under-reporting' of the very serious and complex financial system issues that ultimately triggered the stock market's collapse in 2008. Stewart's anger appears genuine and PALPABLE...I repeat, this is riveting stuff :

Jim Cramer, arguably CNBC's loudest and most famous stock market commentator, was interviewed on Thursday, March 12th by savvy late night comedy news show host Jon Stewart. In the surprisingly edgy and riveting fifteen minute Daily Show segment, Stewart takes a somewhat uncharacteristically somber approach and demands accountability from the Wall Street media and more specifically, CNBC, the #1 U.S. financial news television network. Mr. Stewart seems especially focused on discussing what he (and perhaps many others) perceived as the TV station's collective 'under-reporting' of the very serious and complex financial system issues that ultimately triggered the stock market's collapse in 2008. Stewart's anger appears genuine and PALPABLE...I repeat, this is riveting stuff :